How To Register Non For Profit Organization In Wisconsin

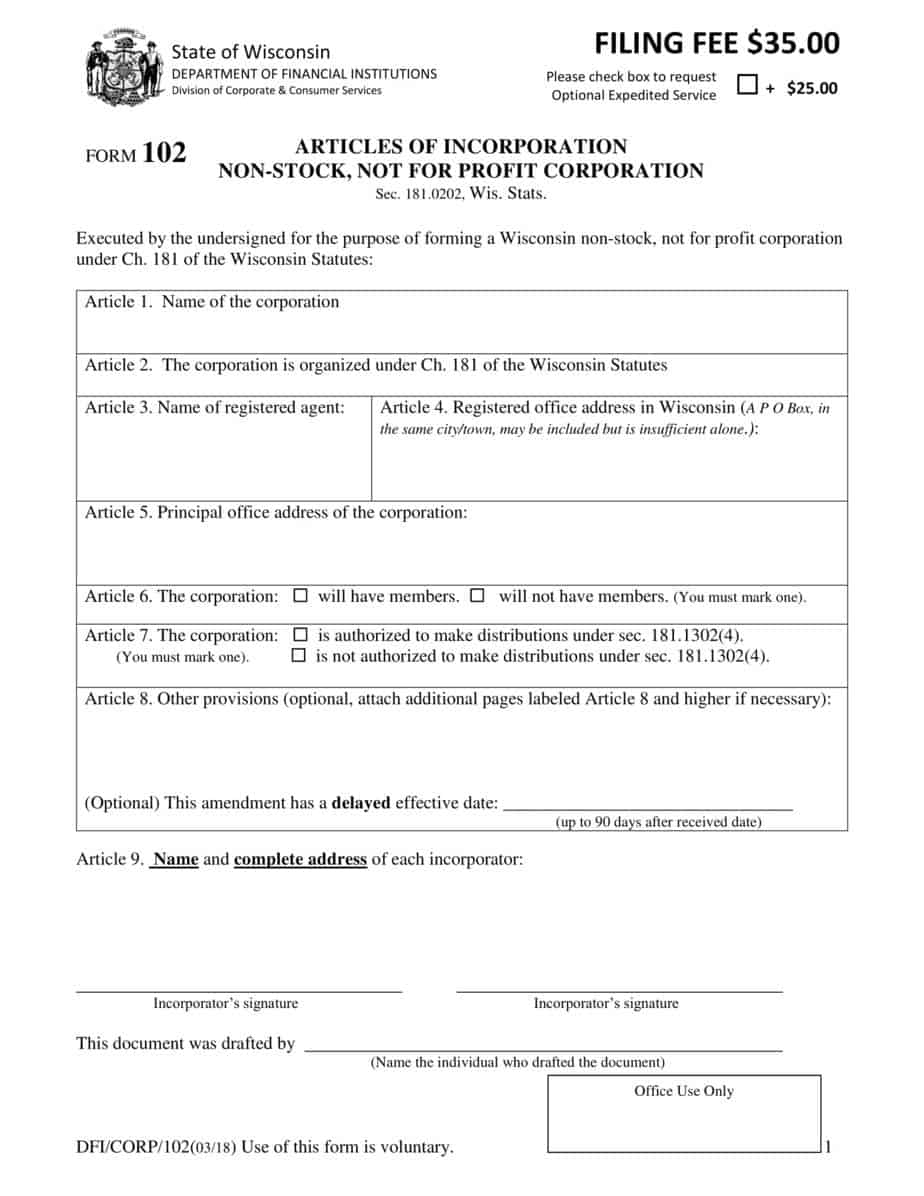

To start a nonprofit corporation in Wisconsin, y'all must file a document called the Articles of Incorporation Non-Stock, Not for Turn a profit Corporation with the Wisconsin Section of Fiscal Institutions. You can file your articles by post or online. The manufactures cost $35 to file. In one case filed with the state, your articles of incorporation officially create your Wisconsin nonprofit corporation, but truly preparing a nonprofit to pursue its mission involves several additional steps.

1

Free PDF Download

Download the Wisconsin nonprofit articles of incorporation. Fill out the form and submit to the state.

Do It Yourself Online

Our free account and tools will walk you through starting and maintaining a Wisconsin nonprofit. All for costless.

1 Twenty-four hours Wisconsin Nonprofit

Includes registered agent service, adaptable bylaws & more.

$ 260 Total

2

To comprise a Wisconsin nonprofit, you must complete and file nonprofit articles of incorporation (Form 102) with the Wisconsin Department of Financial Institutions (DFI). Come across the certificate below and click on any number to run into what information is required in the corresponding section.

one. Name of the Corporation

Your nonprofit's name should exist distinguishable from other business concern entities on record with the Wisconsin DFI, and it should contain 1 of the following words or abbreviations: "corporation," "incorporated," "company," "limited," "corp.," "inc.," "co.," or "ltd." You can exercise a business organization proper name search at the Wisconsin Department of Fiscal Institution's website.

ii. Ch. 181 of the Wisconsin Statutes

The judgement "The corporation is organized under Ch. 181 of the Wisconsin Statutes" should appear in your nonprofit'south articles. This linguistic communication already appears on the grade provided past the state of Wisconsin. If you're preparing your own articles, include this language yourself.

3. Registered Amanuensis

Enter the name of your nonprofit'due south Wisconsin registered agent. This can exist individual Wisconsin resident or a business entity (like Northwest!) authorized to transact business in the land of Wisconsin.

four. Registered Function

Enter the Wisconsin street address of your nonprofit'due south registered office. A registered office is the location where your nonprofit's registered agent will receive service of procedure on your nonprofit's behalf. When you hire Northwest, our Wisconsin street accost goes hither.

five. Principal Office

Enter the mailing address of your nonprofit's primary location in or out of the land. When you lot hire Northwest, yous can put our Wisconsin accost here.

half dozen. Members

Place if your nonprofit volition or volition not have members.

seven. Distributions

Indicate if your nonprofit is authorized to make distributions under section 181.1302(4) of the Wisconsin statutes (see the form for details). In general, Wisconsin nonprofits are not allowed to pay dividends to directors, officers, and/or members, but distributions are possible upon dissolution or if the nonprofit'due south bylaws allow the organization to make distributions to some other domestic or foreign nonprofit.

8. Other Provisions (Optional)

You lot have the selection to include additional, optional provisions on this section of the form, and you tin attach additional pages every bit necessary. If your nonprofit intends to seek 501(c)(3) status from the IRS, you can include the required IRS linguistic communication here—your nonprofit's statement of purpose, for example—and you lot also have the option to delay your nonprofit's effective date up to 90 days after you submit your Wisconsin nonprofit's articles.

9. Incorporator(s)

Lastly, include the proper name and address of each incorporator, as well equally the proper name of the individual who drafted your nonprofit's articles. An incorporator is simply the person who forms your nonprofit. When you lot rent Northwest to create your nonprofit, nosotros'll be your incorporator.

How Much Does It Price to Contain a Wisconsin Nonprofit?

Wisconsin charges $35 to file nonprofit articles of incorporation. If you lot file past mail service, yous can add together on a $25 expedite fee to speed up the filing procedure. Online filings already take less time than mailed filings.

When hire Northwest to course your Wisconsin nonprofit, your total cost, which includes a full year of our registered agent service, is $260.

How Long Does It Accept to Starting time a Wisconsin Nonprofit?

Online filings usually take i business organisation day, though it can sometimes take upwards to five business concern days. Information technology takes more fourth dimension generally for mailed submissions (four-7 business days), simply you tin can likewise pay an extra $25 for 2-day expediting.

When yous hire Northwest to incorporate your nonprofit, nosotros'll file your articles of incorporation online, and the land will typically approve the manufactures within one business day.

Does a Wisconsin Nonprofit Demand a Registered Agent?

Yes, your nonprofit must engage and maintain a Wisconsin registered amanuensis to accept service of procedure (legal notices) on its behalf. The registered amanuensis can exist y'all, a willing associate, or a registered agent service like Northwest. If you decide to have on the job yourself, keep in mind that it'southward a real commitment. A registered agent must be available at a publicly listed accost (a registered office) during normal business organization hours, and this address goes into the public record. It can be tough to manage and grow a new nonprofit when y'all're tied to your desk, and you lot can expect a mailbox full of junk postal service if you put your own domicile or office address on your nonprofit's articles of incorporation.

A improve pick? Hire Northwest instead. Not only will hiring Northwest help resolve the problems mentioned above because our address goes on your manufactures of incorporation in place of yours, but you'll also gain access to our practiced registered amanuensis services. And if we always do receive a service of procedure for your nonprofit, we'll browse it and send it to you lot on the day nosotros receive it.

3

Your nonprofit is required to get an employer identification number (a FEIN or EIN) even if it doesn't have employees. You'll need an EIN to open a bank account and use for federal tax-exempt status with the IRS, and you tin get an EIN every bit soon as the state approves your nonprofit's manufactures of incorporation. Applying is gratis, and you can apply online at the IRS website, by mail, or by fax. Or you lot can allow us get your EIN for you by adding our convenient EIN service, for an additional $fifty fee, when yous rent Northwest.

4

Wisconsin requires nonstock corporations to adopt bylaws at their first official meeting. This is the coming together where your nonprofit elects its directors, appoints officers, and takes intendance of whatsoever other official business organisation necessary to fully complete your system'southward formation and begin its operations. Nonprofits that intend to seek 501(c)(three) federal taxation-exempt status should prefer their bylaws before submitting the Application for Recognition of Exemption to the IRS.

It isn't easy to write effective bylaws, simply Northwest tin help. When yous hire Northwest to class your Wisconsin nonprofit, yous can as well use our adaptable template for writing nonprofit bylaws, along with numerous other free nonprofit forms, to help get things started.

v

Will my Wisconsin nonprofit be tax-exempt?

Not automatically. To obtain federal tax-exempt condition, you'll need to organize your nonprofit in a way that satisfies at least 1 of the tax-exempt categories defined by the IRS nether Section 501(c) of the Internal Acquirement Code. Although there are numerous types of revenue enhancement-exempt nonprofits, about nonprofits exist to serve charitable purposes and seek 501(c)(3) federal tax-exempt status for public charities and private foundations. This involves submitting an Application for Recognition of Exemption (Form 1023 or 1023-EZ), paying a $275 or $600 filing fee, and indelible the 3-half-dozen calendar month process of having your arrangement'southward structure, purpose, and finances examined past the IRS. Yous will also need to make certain your nonprofit's articles of incorporation include provisions using the specific language required past the IRS.

If your system manages to obtain 501(c)(3) condition, contributions to your organization will be tax-deductible by their donors, and your organization will non take to pay the federal corporate tax.

What most country tax exemptions?

If your nonprofit obtains federal taxation exempt status, information technology will be exempt automatically from the Wisconsin franchise and income taxes. Most 501(c)(3) organizations are also exempt from the Wisconsin sales taxation, just you will demand to obtain an Exempt Status number. For more information, delight visit Northwest'due south guide to Wisconsin state tax exemptions.

6

Does a Wisconsin nonprofit demand a business license?

Wisconsin doesn't issue a statewide concern license, simply local jurisdictions may have licensing requirements of their ain. It'southward usually best to contact your local metropolis clerk's office to find out which (if any) licensing requirements apply to your nonprofit'southward activities.

Should my nonprofit register with the Wisconsin Department of Acquirement?

Most probable, especially if your nonprofit will have employees or sell appurtenances of any kind. To register, y'all'll submit Form BTR-101 (the Application for Business Revenue enhancement Registration) to the Wisconsin Section of Revenue. In that location is a $20 initial registration fee, and you'll pay $x to renew your registration every two years.

Should my nonprofit register as a Wisconsin clemency?

Before your Wisconsin nonprofit solicits contributions in the state, you lot must register as a Wisconsin clemency with the Department of Regulation and Licensing. Yous volition need to submit a Charitable Arrangement Registration Argument. There is a $xv charity registration fee and a $54 charitable organization renewal each year.

7

To open a banking concern account for your Wisconsin nonprofit, you will need to bring the post-obit items with you to the bank:

- A copy of your Wisconsin nonprofit articles of incorporation

- A copy of your nonprofit'due south bylaws

- Your Wisconsin nonprofit'south EIN

It'due south wise to call your bank alee of time to bank check its requirements. Some banks may crave you lot to bring a resolution authorizing you to open up a bank account in your nonprofit'southward name (particularly if your nonprofit has several directors and/or officers).

8

Wisconsin requires nonprofits to submit annual reports each twelvemonth updating (or merely confirming) your organization's information as it appears on the state'southward records. At that place is a $10 filing fee, and the report is due at the end of your organization'south anniversary quarter each year. You lot can file your Wisconsin nonprofit's annual report online at the Wisconsin Department of Financial Institution's website.

When you hire Northwest, nosotros'll automatically remind y'all about your nonprofit'south annual report deadlines, just you lot can likewise sign up for our Wisconsin Annual Report Service, for an additional fee, and get out the hassle to u.s..

Let The states Be Your Guide

At Northwest Registered Agent, we've spent years crafting our Wisconsin Nonprofit Service. When y'all hire the states, we'll form your Wisconsin nonprofit for $260 full and include:

- I year of registered amanuensis service

- Digital notifications

- Wisconsin annual report reminders and directions for fast filing

- A secure online account filled with intuitive business maintenance tools and forms to make upkeep simple

- Lifetime Corporate Guide Service—phone call us anytime and ane of our Corporate Guides will assistance you navigate whatever business problem, job or marvel you take.

Northwest Registered Agent is the only national nonprofit germination service dedicated to your personal privacy. We don't well data to third-parties, and nosotros do everything we tin can to keep your personal data secure.

How To Register Non For Profit Organization In Wisconsin,

Source: https://www.northwestregisteredagent.com/nonprofit/wisconsin

Posted by: steinwhart1999.blogspot.com

0 Response to "How To Register Non For Profit Organization In Wisconsin"

Post a Comment